Mr & Mrs Michael v HMRC TC/2022/12710 was an appeal involving a claim by the taxpayers that the property they had purchased was of mixed residential and non-residential land for stamp duty purposes due to the presence of a woodland of 3.5 acres at the back of their dwelling and its garden of half an acre.

The FTT did not accept the taxpayers’ evidence that the woodland did not provide any privacy or security for the half-acre garden and dwelling and so was not a part of the grounds of the dwelling and it applied mechanistically the nine principles derived from various SDLT cases on “grounds” as articulated by Judge Baldwin in Faiers v HMRC [2023] UKFTT 212 (TC) at [44] to decide that the entire property was residential and so subject to the rates of tax in Table A.

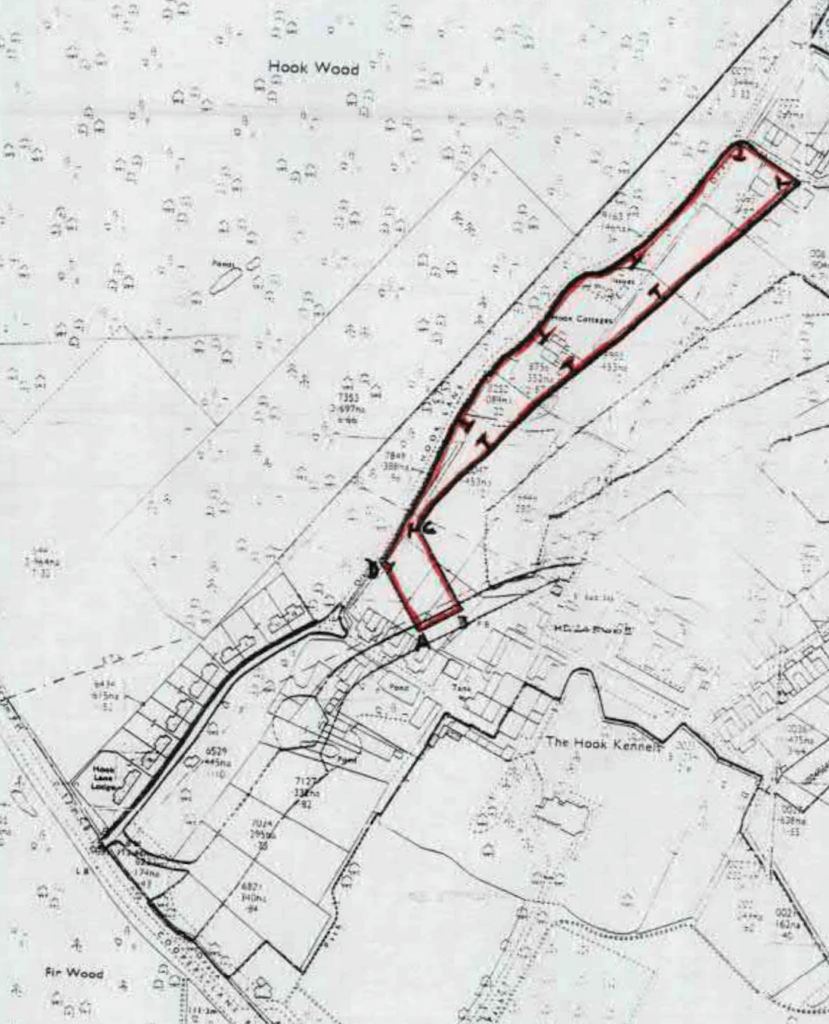

Mr & Mrs Michael Transfer Plan

To read the full decision, click here.